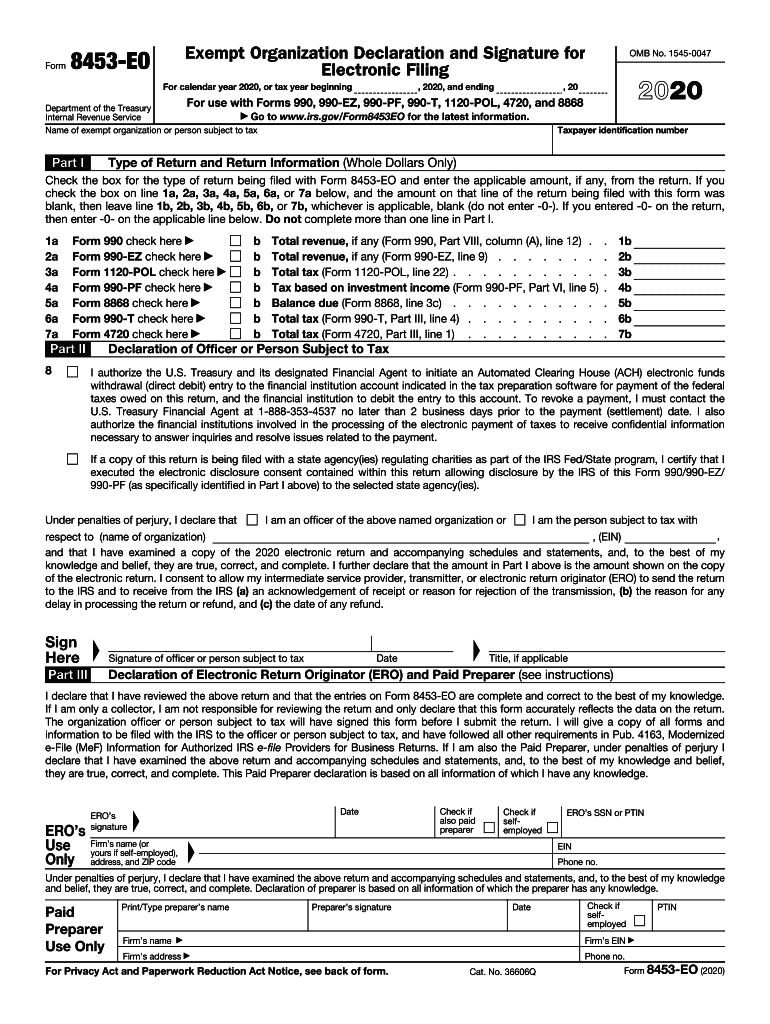

Who Needs Form 8453-EO?

Form 8453 is officially called Exempt Organization Declaration and Signature for Electronic Filing. It is created for exempt organizations or for the entities who have file forms 990, 990-EZ, 990-PF, 1120-POL and 8868.

What is Form 8453-EO for?

There is a number of reasons for an exempt organization to fill out Form 8453. You must use the form to:

- Prove that electronic forms that an organization has already filed are true

- Authorize electronic submission of the return to the IRS.

- Authorize the ISP — service provider that to submit the return via third party transmitter

- Prove that electronic funds withdrawal for federal taxes was correct

All the information that has to be authorized must be taken from the forms mentioned above.

Is Form 8453-EO accompanied by other forms?

Form 8453-EO is filed together with electronically filed returns: Forms 990, 990-EZ, 990-PF, 1120-POL.

When is Form 8453-EO due?

The due date for the form coincides with the due date of the returns it is attached to. For example, forms 990 and 990-EZ are submitted to the IRS by the 15th day of the 4th month after the end of the organization’s accounting period. If it is a weekend or official holiday, the deadline is moved to the next business day. The same is for the Form 1120-POL. However, Form 8868 is filed by the date for which an extension was asked.

How do I fill out Form 8453-EO?

Filing Form 8453-EO can be absolutely stress-free since the form doesn’t require any calculations. You simply take information from the forms you’ve already filed. In total, there are three parts to be completed.

- Part 1 contains return information. Check the corresponding boxes and put the whole amount where required

- Part 2 is a declaration of officer where you have to check the box to authorize electronic withdrawal of the funds

- Part 3 requires you to state that previously e-filed forms are correct. Below provide the name of ERO, its SSN, phone number and address.

Where do I send Form 8453-EO?

When you are ready with the form, send it to the IRS. If you’re using tax preparation software, transmit this form in PDF format together with your return.