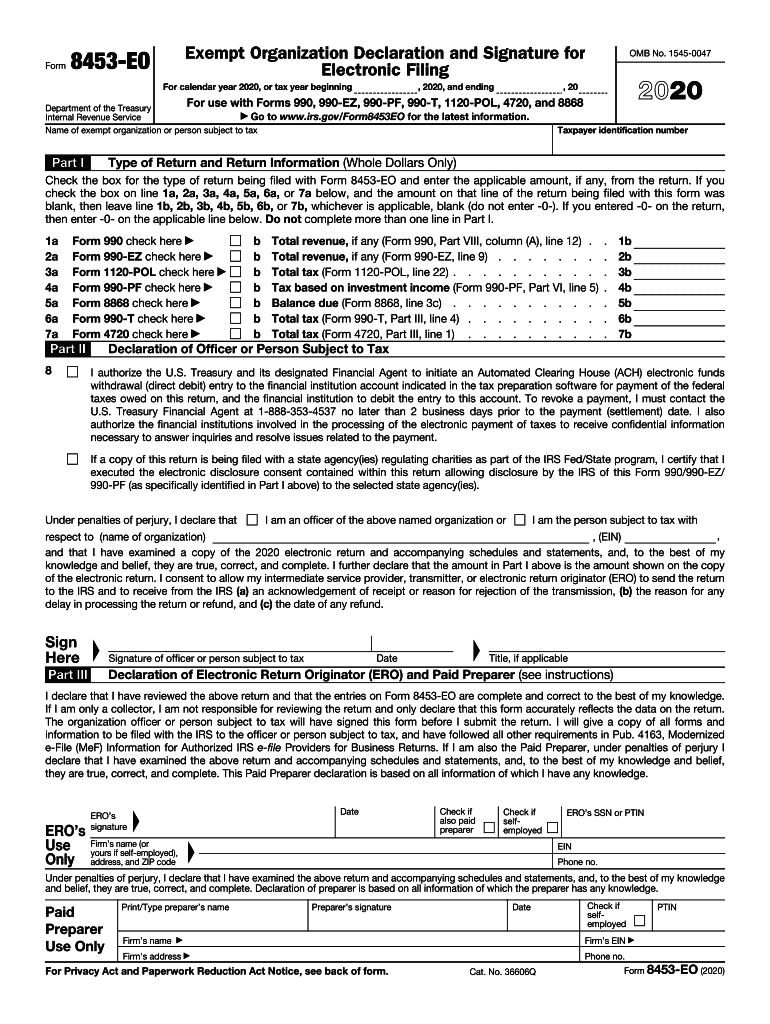

IRS 8453-EO 2020-2026 free printable template

Instructions and Help about IRS 8453-EO

How to edit IRS 8453-EO

How to fill out IRS 8453-EO

Latest updates to IRS 8453-EO

All You Need to Know About IRS 8453-EO

What is IRS 8453-EO?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8453-EO

What should I do if I need to correct a mistake on my IRS 8453-EO?

To correct a mistake on your IRS 8453-EO, you will need to submit an amended version of the form. Ensure that you clearly indicate which information has been corrected, and provide any necessary supporting documentation to explain the changes. Remember to keep copies for your records and track the submission to ensure it is processed correctly.

How can I check the status of my submitted IRS 8453-EO?

You can check the status of your submitted IRS 8453-EO by visiting the IRS website or using their e-filing service provider's tracking tools. Watch for common e-file rejection codes and respond promptly to any alerts that you may receive, as these can indicate further action is required to complete the processing of your form.

What are the privacy and data security measures for filing an IRS 8453-EO electronically?

When filing IRS 8453-EO electronically, ensure that you utilize approved e-filing software that adheres to IRS standards for privacy and data security. This software often implements encryption, secure storage, and user authentication to safeguard sensitive information against unauthorized access during transmission and storage.

How should nonresidents handle filing an IRS 8453-EO?

Nonresidents must be aware of specific guidelines when filing an IRS 8453-EO. They should verify whether they require additional forms or documentation to reflect their unique tax situation and consider consulting a tax professional familiar with international tax regulations and obligations.

What happens if I receive an audit notice regarding my IRS 8453-EO?

If you receive an audit notice regarding your IRS 8453-EO, it is important to review the notice carefully and gather necessary documentation to support your original submission. Respond to the notice in the timeframe provided, and consider seeking assistance from a tax professional to address any issues raised in the audit.